Learn More About Pension/Annuity Plan

These financial products are offered by insurance companies or financial institutions designed to provide individuals with a regular stream of income during their retirement years in exchange for a lump-sum premium payment or a series of premium payments made over a specified period. They offer several benefits, making them a popular choice for individuals looking to secure a regular income during their retirement years.

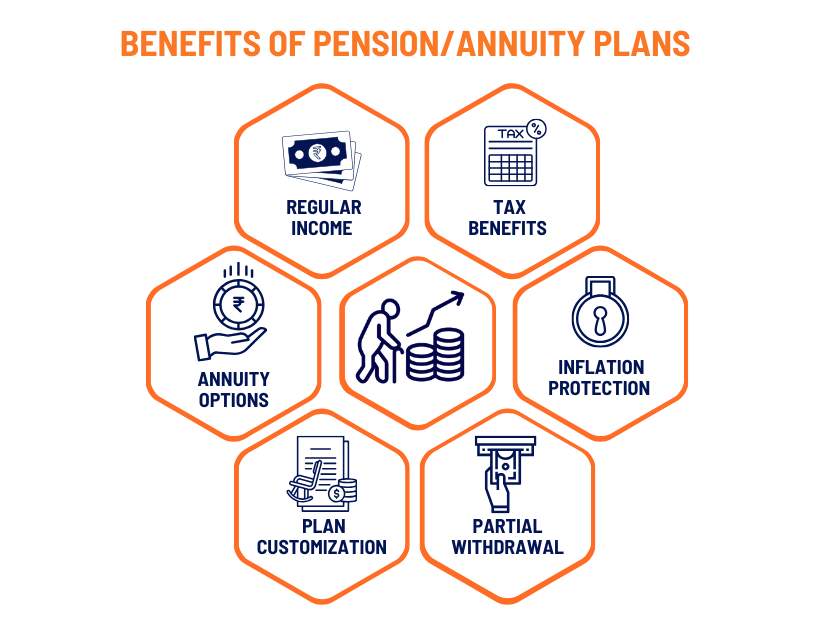

Regular Income : The primary purpose of annuity plans is to offer a regular and predictable income to policyholders during their retirement. This income can help retirees cover their living expenses, medical bills, and other financial needs.

Inflation Protection : Some plans have inflation-adjusted payouts, helping retirees maintain their purchasing power over time by increasing the annuity payments to keep pace with rising costs.

Premium Payment : To purchase an annuity plan, individuals typically make a lump-sum payment or a series of premium payments to the insurance company or financial institution. The size and frequency of premium payments may vary depending on the specific annuity plan chosen.

Types of Annuities :

- Immediate Annuities : These plans begin providing regular income immediately after the lump-sum premium payment. They are suitable for those who are already retired or close to retirement.

- Deferred Annuities : These plans have an accumulation phase during which the premium is paid, followed by a distribution phase during retirement. The annuity payments start at a later date, providing individuals with time to accumulate savings before retirement.

- Fixed Annuities : These plans offer a fixed and predetermined payout amount throughout the annuity period, providing stability but potentially lower returns.

- Variable Annuities : These plans offer annuity payments that can vary based on the performance of underlying investments, offering the potential for higher returns but also greater risk.

- Joint Annuities : Some annuity plans allow policyholders to choose joint annuities, which provide income not only for the primary policyholder but also for their spouse or another beneficiary after their demise.

Tax Benefits : The income received from an annuity plan may be partially or fully tax-exempt, depending on the terms of the plan and prevailing tax laws.

Premature Withdrawal : These plans typically lack liquidity, but some plans may allow for partial withdrawals or surrender options under certain circumstances.

Disclaimer : An individual considering annuity or pension plans should carefully evaluate their financial goals, risk tolerance, and retirement needs before selecting a specific plan. It is important to carefully review and understand the terms and conditions provided by the insurance company. The information provided should not be taken as financial advice, and it's recommended to consult with a qualified financial advisor to ensure that the policy aligns with your specific financial goals and needs.