Learn More About Health Insurance

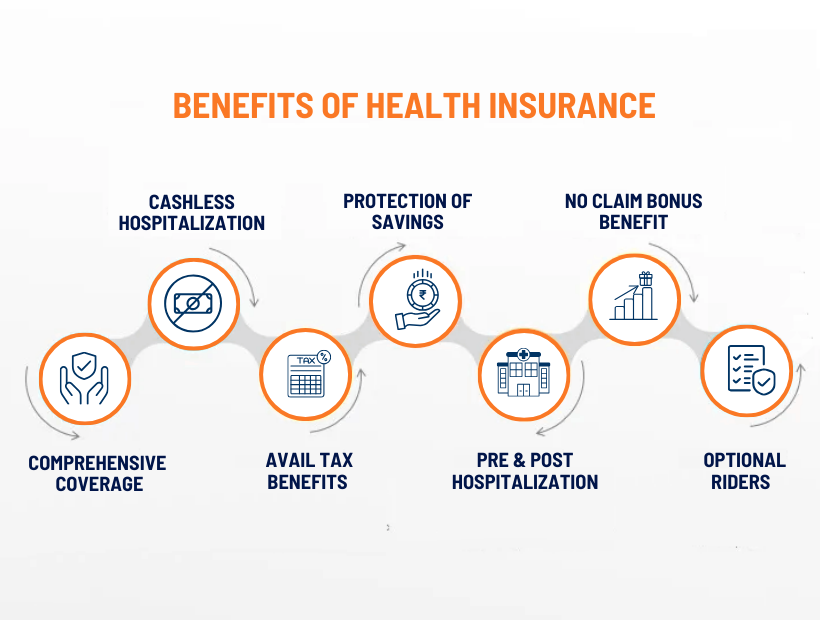

Health insurance is a financial contract where individuals or companies pay regular premiums to an insurance provider in exchange for coverage and financial protection against medical expenses. In the event of illnesses, injuries, or medical treatments, health insurance helps mitigate the financial burden & covers expenses related to hospitalization, doctor consultations, surgeries, prescription medications, and preventive care, among other healthcare services.

Coverage and Benefits : Evaluate the coverage provided by the policy. Look for benefits such as hospitalization expenses, surgeries, doctor consultations, diagnostic tests, medications, maternity coverage (if needed), and coverage for pre-existing conditions. Make sure the policy covers a wide range of medical treatments and services relevant to your health needs.

Network Hospitals : Check the list of network hospitals where you can avail of cashless treatment. Ensure that the network includes reputable hospitals and medical facilities in your preferred locations for easy accessibility during emergencies.

Sum Insured : The sum insured is the maximum amount the insurance company will pay for medical expenses in a policy year. Choose a sum insured that adequately covers potential healthcare costs without being excessive. Factors like your family size, medical history, and location can influence this decision.

Pre-existing Conditions : If you have pre-existing medical conditions, verify whether the policy covers them and whether there is a waiting period before coverage becomes effective. Some policies might exclude pre-existing conditions initially or have waiting periods before they are covered.

Waiting Periods : Understand the waiting periods for specific conditions. Some policies have waiting periods for certain treatments or illnesses, during which claims related to those conditions will not be accepted. Make sure you're aware of these waiting periods.

Co-payment and Sub-limits : Check if the policy has any co-payment clauses or sub-limits on specific expenses. Co-payment requires you to share a certain percentage of the medical expenses, while sub-limits impose caps on expenses related to specific treatments.

Coverage Renewal Age : Some policies have an upper age limit for renewals. Choose a policy that allows you to continue coverage even as you grow older, especially considering that health needs tend to increase with age.

No Claim Bonus : Look for policies that offer a no-claim bonus, which increases your sum insured for every claim-free year. This can provide added financial protection in the long run.

Claim Process & Customer Service :Research the claim settlement process of the insurance company. A smooth and hassle-free claims process is crucial during medical emergencies. Read reviews or seek feedback about the company's customer service quality.

Exclusions : Every policy has certain exclusions, such as cosmetic treatments, dental treatments, robotic surgeries or certain experimental procedures. Read about exclusions in details before opting for a health insurance.

Maternity Coverage : If you're planning a family or need maternity coverage, ensure that the policy offers comprehensive coverage for prenatal, maternity, and postnatal expenses.

Additional Benefits : Some policies offer additional benefits such as wellness programs, coverage for alternative treatments, and international coverage for emergencies. Consider these extras, if they align with your needs.

Policy Renewal Terms : Review the renewal terms and conditions, including any changes in premium rates, coverage, or benefits upon renewal.

Portability : Check if the policy allows you to switch to another insurance provider without losing your accumulated benefits and waiting periods.

Disclaimer : Understanding health insurance can be challenging, and it's important to think carefully and seek advice from experts before making choices. The rules and regulations may change depending on where you live, the insurance company you pick, and your personal situation. It's a good idea to talk to financial advisors who can give you advice that fits your own needs before you decide about health insurance. It's also crucial to read and understand all the details related to the inclusions and exclusions in any health insurance plan you're looking at.