Learn More About Guaranteed Income Plan

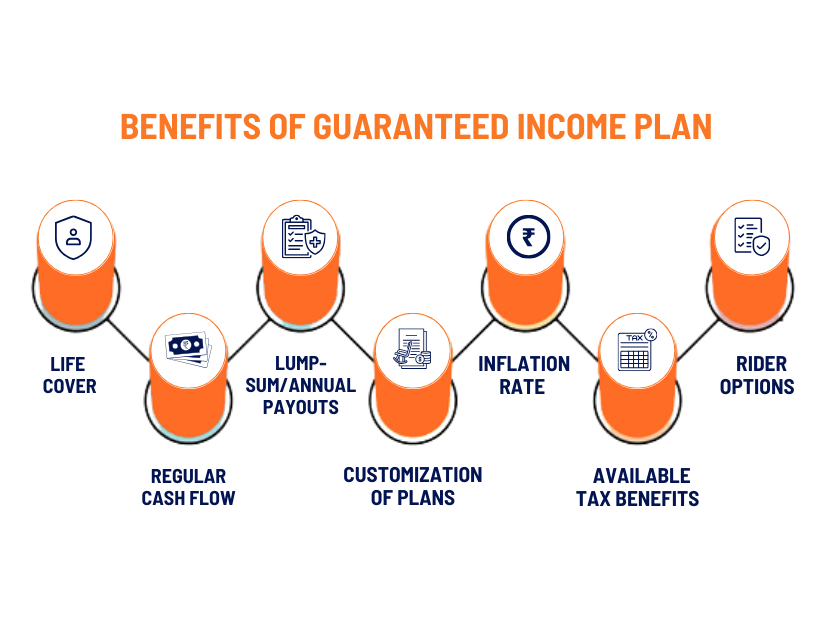

Life Cover : Guaranteed savings plans provide you with a life cover, throughout the tenure of the policy. This ensures that your loved ones are financially secured in case of an unfortunate event.

Guaranteed Maturity benefits : When you invest in a guaranteed savings plan, you get an assured amount at maturity. This guaranteed amount is pre-decided at the time of the purchase of the policy, and hence, prepares you financially to achieve your goals.

Premium of Choice : You can choose the premium amount you want to pay regularly. This gives you the flexibility to invest as per your convenience and requirements. However, some plans may have a minimum premium amount to be paid.

Riders : It refers to additional features that can be added to a financial product providing specific advantages or coverage beyond the standard terms, often allowing policyholders to customize their coverage to better suit their needs

Flexibility Premium Paying Terms : It refers to the ability of a financial product which allows the policyholder to choose different payment schedules for their premiums, offering options such as monthly, quarterly, or annual payments. It gives the ability to adjust premium amounts over time to accommodate changing financial circumstances.

Payout Options : These plans provide you multiple payout options to choose from depending on the plan you purchase. You can choose to receive your money from the plan as a lump sum, regular income, or a mix of both as per your requirements.

Tax Benefits : Since a guaranteed savings plan is a life insurance plan, the premiums paid towards the plan are allowed as deduction up to ₹ 1.5 lakh per annum under Section 80C of the Income Tax Act, 1961. The payouts received from the plan are also tax-free (Subject to conditions under Section 10(10D) of the Income Tax Act, 1961)

Disclaimer : Before investing in any guaranteed income plans, it's essential to assess your financial goals and risk tolerance to determine the best fit for your needs. It's important to carefully review the terms, features, and benefits of each type of guaranteed income plan to ensure it aligns with your financial goals and requirements. Consulting with a financial advisor can help you make an informed decision based on your individual circumstances.