Learn More About Endowment Plan

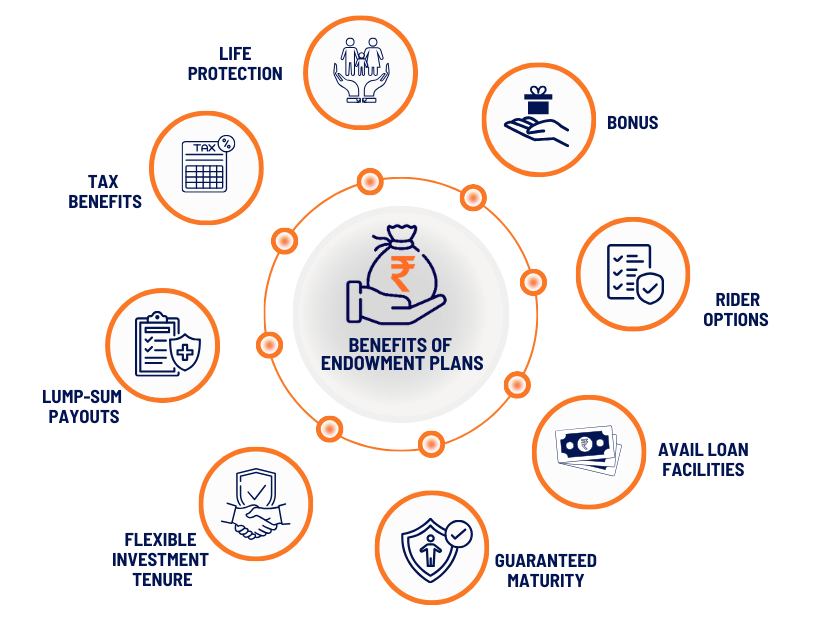

An Endowment Plan is a life insurance policy that combines protection and savings. It provides a lump-sum or regular payout to the policyholder or their beneficiaries upon maturity or in the event of the policyholder's death. These plans offer both financial security and a way to accumulate wealth over a specified term.

Traditional Endowment Plan : A life insurance policy that provides a guaranteed sum assured along with bonuses upon maturity or in case of the policyholder's demise. It offers a safe and predictable way to save and protect.

Unit-Linked Endowment Plan (ULIP) : This plan combines life insurance with investment in a variety of funds. It allows policyholders to choose their investment strategy and potentially benefit from market returns while providing life coverage.

Money-Back Endowment Plan : A variant of the endowment plan that offers periodic payouts at specified intervals during the policy term. This provides liquidity at regular intervals, making it suitable for meeting various financial needs.

Child Endowment Plan : Specifically designed to secure a child's future, this policy provides a lump sum amount for the child's education or other significant milestones in case of the policyholder's demise or at maturity.

Joint Endowment Plan : This type of plan covers two individuals under a single policy, typically a couple. It provides a payout upon the demise of either policyholder or at maturity, offering financial security to both.

Low-Cost Endowment Plan : A variation of the traditional endowment plan with lower premiums. It offers a reduced sum assured and is designed for those seeking insurance coverage on a budget.

Single-Premium Endowment Plan : In this plan, the policyholder pays a lump sum premium at the beginning of the policy term, and the policy accrues value over time, providing a payout on maturity or in case of death.

Endowment Assurance Plan : Offers a higher sum assured than traditional endowment plans, providing greater financial security to the policyholder's beneficiaries in the event of the policyholder's demise.

Disclaimer : While endowment plans offer various advantages, they might not be the most efficient investment option for everyone. Before investing in any endowment plans, it's essential to assess your financial goals, and risk tolerance, and explore alternative investment options to determine the best fit for your needs. It's important to carefully review the terms, features, and benefits of each type of endowment plan to ensure it aligns with your financial goals and requirements. Consulting with a financial advisor can help you make an informed decision based on your individual circumstances.