Let's work together to unlock your financial potential and achieve your dreams

Critical illness plans are insurance policies that provide coverage for a specific list of critical illnesses. These plans offer financial protection to policyholders in case they are diagnosed with one of the covered critical illnesses during the policy term.

Coverage : Critical illness plans typically cover a predefined list of critical illnesses, which may include conditions like cancer, heart attack, stroke, kidney failure, major organ transplant, paralysis, and more. The number and types of illnesses covered may vary from one insurance provider to another.

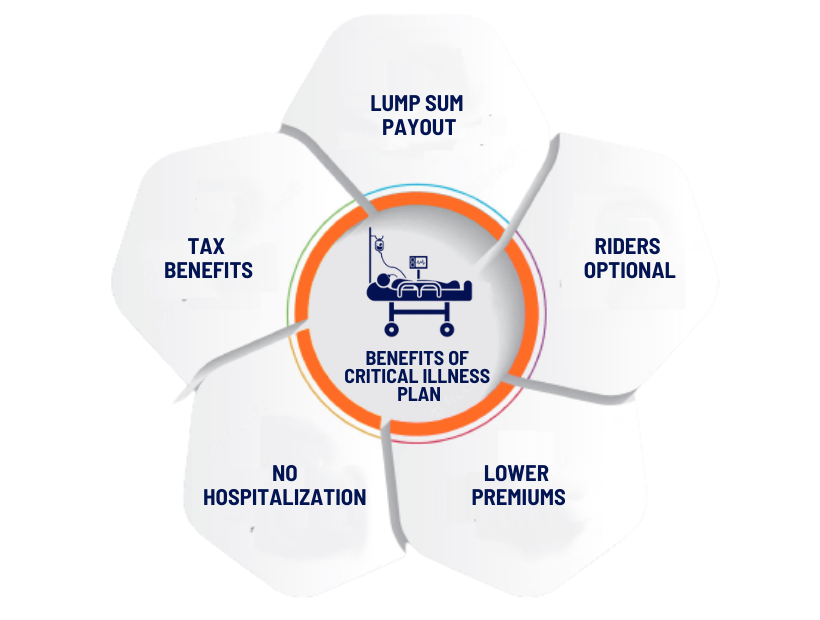

Lump-Sum Payout : When a policyholder is diagnosed with a covered critical illness, the insurance company pays a lump-sum amount (sum insured) to the policyholder. This payout is tax-free and can be used to cover medical expenses, loss of income, or any other financial needs.

Waiting Period : Most critical illness plans have a waiting period, which means that the policyholder must survive for a specified period (usually 30 days) after the diagnosis of the critical illness before they can make a claim.

No Hospitalization Required : Unlike regular health insurance policies, critical illness plans do not require hospitalization to make a claim. The diagnosis of the critical illness is sufficient to trigger the payout.

Premiums : Policyholders pay regular premiums to maintain their critical illness coverage. Premiums may vary based on factors such as age, sum insured, and the policyholder's medical history.

Additional Riders : Some insurers offer riders or add-ons that can be attached to critical illness plans. These riders can provide extra coverage for conditions not included in the standard list or offer benefits like waiver of premium in case of disability.

Renewability : Most critical illness plans are renewable, which means that policyholders can renew their coverage on an annual basis, subject to the insurer's terms and conditions. Premiums may increase with age and renewed policy terms.

Claim Process : To make a claim under a critical illness plan, the policyholder typically needs to provide medical records and reports confirming the diagnosis. The insurer will then assess the claim and make the payout if the claim is approved.

Disclaimer : It's important to carefully read and understand the terms and conditions of a critical illness plan before purchasing one. Additionally, consider factors like the coverage amount, waiting period, and the list of covered critical illnesses when choosing a plan. Consulting with a financial advisor or insurance expert can also be beneficial in making an informed decision.