Let's work together to unlock your financial potential and achieve your dreams

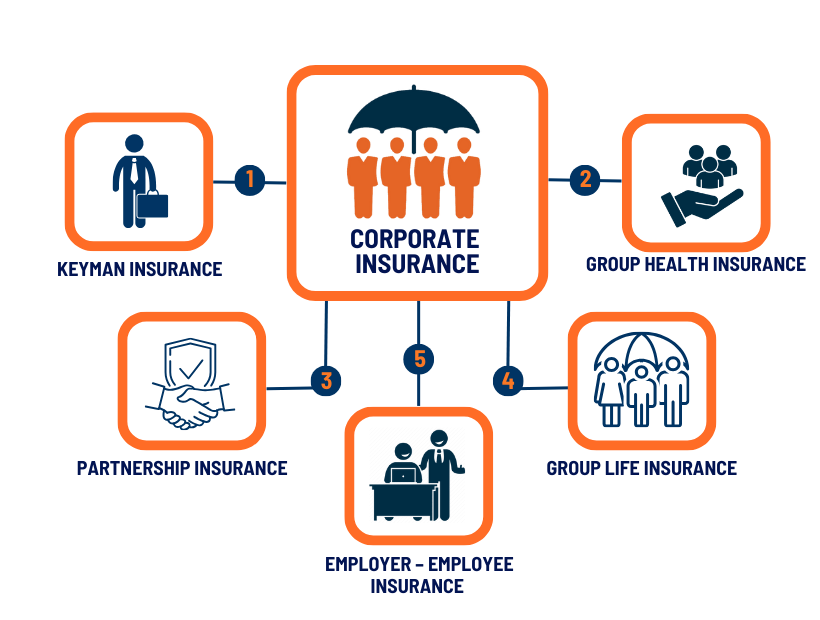

Business insurance refers to a type of insurance coverage designed to protect businesses and their assets from various risks and liabilities. It provides financial protection in the event of unexpected events or disasters that could potentially disrupt or harm a business's operations. Business insurance policies in India can cover a wide range of risks and can be customized to meet the specific needs of different types of businesses. Some common types of business insurance are given below;

Keyman Insurance : Keyman insurance, also known as key person insurance, is a type of life insurance policy that a business purchases to financially protect itself against the loss of a key employee or individual whose expertise, skills, knowledge, or leadership are crucial to the company's success. In this type of insurance, the business is the policyholder, premium payer, and beneficiary.

Purpose : The primary purpose of keyman insurance is to provide the business with financial support in case a key person within the organization, such as a founder, CEO, top executive, or key employee, passes away or becomes critically ill. The insurance payout can help the company navigate the challenges that may arise due to the loss of that individual.

Policy Ownership : The business owns the policy, pays the premiums, and is the beneficiary of the policy. This means that if the insured key person passes away or becomes incapacitated, the business receives the insurance payout.

Coverage Amount : The coverage amount (the sum assured) is determined based on the financial impact the loss of the key person would have on the company. It typically covers the costs of finding and training a replacement, potential loss of revenue, and other financial consequences of the key person's absence.

Premium Payments : The business is responsible for paying the premiums for the policy. Premiums are generally not tax-deductible unless they are paid as part of an employee compensation package.

Key Person Definition : To qualify for keyman insurance, the insured individual must meet specific criteria set by the insurance company. They are typically individuals who have a significant impact on the company's profitability, operations, or strategic direction.

Tax Implications : Keyman insurance benefits may have tax implications. The payout may be taxable as income, or there may be restrictions on claiming tax benefits for premium payments. Business owners should consult with tax professionals to understand the tax implications in their specific jurisdiction.

Employer-employee schemes are designed to create a positive and supportive work environment, improve employee satisfaction and retention, and contribute to the overall success of the organization. They refer to a program or arrangement established by an employer to provide various benefits or incentives to its employees. These schemes are designed to enhance the overall compensation package of employees, boost morale, attract and retain talent, and promote employee well-being. The specific components and features of an employer-employee scheme can vary widely depending on the organization, industry, and local regulations.

Salary and Compensation Packages : Employers may structure their compensation packages to include various components, such as basic salary, bonuses, incentives, and allowances, to provide competitive and attractive total compensation to employees.

Employee Benefits : Employers often offer a range of benefits, including health insurance, life insurance, disability insurance, retirement plans and other perks like dental coverage, vision care, and wellness programs.

Performance-Based Incentives : Bonuses, profit-sharing plans, and performance-related pay are often used to motivate and reward employees based on their individual and/or team performance.

Training and Development : Employers may invest in employee training and development programs to enhance skills, knowledge, and career growth opportunities.

Flexible Work Arrangements : Offering flexible work hours, telecommuting, or remote work options can help employees achieve a better work-life balance.

Employee Recognition and Awards : Recognition programs, awards, and employee of the month/year initiatives can boost employee morale and motivation.

Wellness Programs : Employers may promote employee health through wellness programs that include fitness memberships, health screenings, and wellness challenges.

Transportation and Commuting Benefits : In some areas, employers provide benefits like subsidized public transportation passes or parking allowances.

Housing and Relocation Assistance : For certain positions or industries, employers may offer housing allowances or relocation packages to help employees with housing and moving costs.

Employee Discounts : Discounts on company products or services can be a valuable perk for employees.

Partnership insurance also known as "Partnership Protection Insurance" is a type of insurance policy designed to provide financial protection to partners in a business partnership in the event of the death, disability, or exit of one of the partners. This insurance helps ensure the smooth transition of the business ownership and continuity of operations during such events. Here are the key benefits of partnership insurance,

Financial Security : Partnership insurance provides financial security to the surviving partners and the families of deceased or disabled partners. In the event of a covered triggering event, the insurance payout can replace the lost income, facilitate the purchase of the departing partner's share, and help meet financial obligations.

Asset Protection : It helps protect the personal assets of the surviving partners from potential claims by the deceased or disabled partner's estate or creditors.

Business Continuity : In the absence of a partnership insurance policy, the death or disability of a partner can disrupt business operations and lead to uncertainty about the future of the business. With partnership insurance in place, the surviving partners can use the insurance proceeds to buy out the departing partner's share and ensure business continuity.

Employee Retention : Partnership insurance can provide peace of mind to employees, clients, and stakeholders, as they know that the business is prepared for unforeseen events. This can contribute to employee retention and customer confidence.

Smooth Transition :Partnership insurance is often linked to a legally binding buy-sell agreement. This agreement outlines the terms and conditions under which the ownership interest of a partner can be sold or transferred. The insurance payout serves as the funding mechanism to execute this agreement smoothly.

Valuation Assistance : The insurance policy helps partners determine the value of the departing partner's share. This valuation can be complex, and the insurance proceeds provide a ready source of funds to facilitate the buyout.

Estate Planning : For partners who want to ensure that their share of the business is handled according to their wishes in the event of their death, partnership insurance can be a crucial part of their estate planning strategy. It helps guarantee that the business interest is transferred as desired.

Creditworthiness : A partnership with a well-structured partnership insurance policy may be viewed more favourably by lenders, as it demonstrates a commitment to risk management and business continuity planning.

Flexibility :Partnership insurance policies can be tailored to the specific needs of the business and the partners involved, including coverage amounts, triggering events, and premium structures.

Group Life Insurance is a valuable employee benefit that provides financial security to the families of insured individuals. It provides life insurance coverage to a group of individuals, typically employees of an organization, members of an association, or members of a particular group. This insurance coverage is offered by employers or associations as part of their employee benefits or membership benefits package. Group Life Insurance is designed to provide financial protection to the families of insured individuals in the event of their death. Here are some key features and aspects of Group Life Insurance are as follows;

Coverage for a Group : Group Life Insurance provides coverage to a defined group of individuals, which may include employees of a company, members of a cooperative society, members of a professional association, or any other group that qualifies for the coverage.

Master Policyholder : The organization or entity offering the Group Life Insurance policy is known as the master policyholder. This entity is responsible for purchasing and managing the insurance coverage on behalf of the group members.

Life Coverage : Group Life Insurance policies provide a lump-sum death benefit to the beneficiary or nominees of the insured individual in the event of their death during the policy term. This benefit is typically a multiple of the insured individual's salary or a fixed amount.

Affordable Premiums :Group Life Insurance premiums are often more affordable than individual life insurance policies because the risk is spread across a larger group of people. Premiums may be fully or partially paid by the employer or organization.

No Medical Underwriting : In many Group Life Insurance policies, there is no requirement for individual medical underwriting or health checks. This makes it easier for group members to qualify for coverage.

Nomination : Insured individuals typically have the option to nominate their beneficiaries who will receive the death benefit in the event of their passing. The nomination can be updated as needed.

Tax Benefits : Premiums paid by employers are often tax-deductible expenses, and the death benefit received by the nominee is usually tax-free under Section 10(10D) of the Income Tax Act, 1961.

Group Size : Insurance providers in India may have minimum and maximum group size requirements for offering Group Life Insurance coverage.

Portability : In some cases, employees may have the option to continue their coverage even if they leave the group (e.g., change employers). This is known as portability.

Additional Riders : Employers or group policyholders may have the option to add riders or supplementary benefits to the Group Life Insurance policy, such as accidental death and disability coverage.

Group health insurance is a type of health insurance policy that provides coverage for a group of individuals, typically employees of a company or members of an organization or association. It is an essential employee benefit that helps ensure that group members have access to quality healthcare services while also offering financial protection against unexpected medical expenses. It is an important employee benefit that helps protect the health and well-being of group members by covering medical expenses and providing access to healthcare services. Here are some key features and aspects of group health insurance;

Coverage for a Group : Group health insurance policies provide coverage to a defined group of individuals. This group can include employees of a company, members of a cooperative society, members of a professional association, or any other group that qualifies for the coverage.

Master Policyholder : The organization or entity offering the group health insurance policy is known as the master policyholder. This entity is responsible for purchasing and managing the insurance coverage on behalf of the group members.

Comprehensive Coverage : Group health insurance typically offers comprehensive coverage for medical expenses, including hospitalization, doctor's fees, surgical procedures, diagnostic tests, and sometimes dental and maternity care.

Affordable Premiums :Premiums for group health insurance policies are often more affordable than individual health insurance plans because the risk is spread across a larger group of people. Employers or group policyholders may partially or fully subsidize the premiums for their employees or members.

No Medical Underwriting : In many group health insurance policies, there is no requirement for individual medical underwriting or health checks. This makes it easier for group members to qualify for coverage.

Pre-Existing Conditions : Group health insurance policies may cover pre-existing medical conditions of group members from day one or after a waiting period, depending on the policy terms.

Coverage Flexibility : Group policyholders often have the flexibility to choose the coverage options and benefit limits that best suit the needs of their group members.

Cashless Claims : Many group health insurance policies offer cashless claim settlement facilities, allowing insured individuals to avail medical treatment at network hospitals without paying upfront (subject to policy terms and conditions).

Portability : In some cases, employees may have the option to continue their group health insurance coverage even if they leave the group (e.g., change employers). This is known as portability.

Additional Riders : Employers or group policyholders may have the option to add riders or supplementary benefits to the group health insurance policy, such as coverage for critical illnesses or maternity benefits.

Disclaimer : Investing in business insurance is a prudent step to safeguard your financial interests. However, it's essential to understand that the terms and coverage provided are subject to the specific policy contract, terms, and conditions. The effectiveness of your insurance policy depends on accurate and truthful disclosures during the application process. Any misrepresentation or concealment of material facts can impact the validity of your coverage. Additionally, the benefits and limitations of the policy, including premium payments and claim procedures, should be carefully reviewed and followed. It is crucial to consult with insurance professionals and thoroughly read the policy document to comprehend the full scope of your business insurance coverage.