Let's work together to unlock your financial potential and achieve your dreams

Corporate Fixed Deposits (FD’s) are investment instruments offered by companies to individuals, retail investors, and other entities to raise funds for their operations or expansion. They are similar to regular bank fixed deposits but are issued by Non-Banking Financial Company or Companies instead of banks. These fixed deposits offer a fixed interest rate over a specific period of time, and at the end of the maturity period, the principal amount along with the interest earned is returned to the investor.

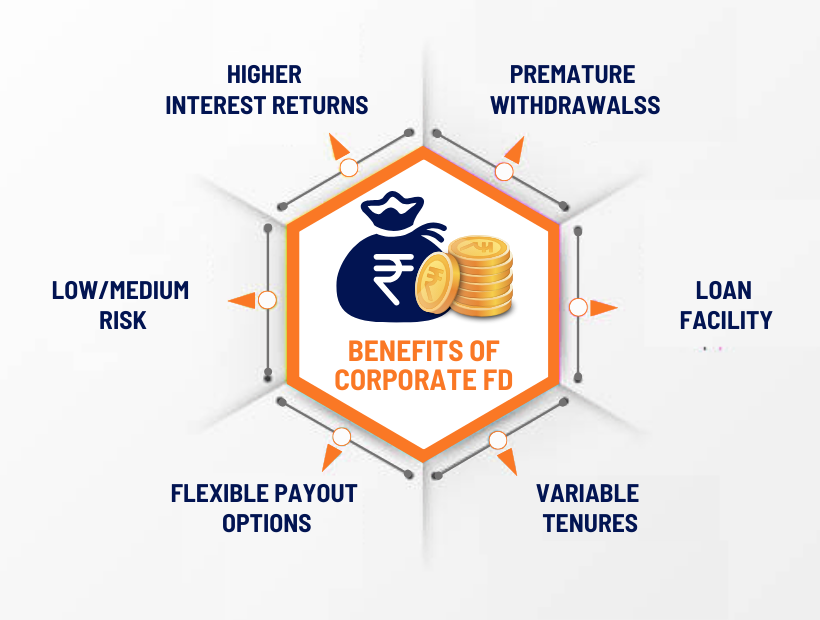

Higher Interest Rates : Corporate FD’s often offer higher interest rates compared to traditional bank FD’s. This can be appealing for investors seeking better returns on their fixed-income investments.

Diversification : Including corporate FD’s in your investment portfolio can provide diversification. By diversifying across different types of assets, including different types of fixed deposits, you can potentially reduce overall risk in your investment portfolio.

Regular Income : Corporate FD’s provide a fixed interest income at regular intervals (usually monthly, quarterly, or annually), which can be useful for individuals seeking a steady income stream.

Tenure Options : Corporate FD’s come with various tenure options, allowing you to choose a duration that aligns with your investment horizon and financial goals.

Flexibility : Some corporate FD’s offer flexible interest payout options, where you can choose to receive the interest at maturity along with the principal, or periodically as per your preference.

Ease of Investment : Investing in corporate FD’s is usually straightforward. It involves filling out an application form and providing necessary documents, similar to bank FD’s.

Shorter Lock-In Periods : Some corporate FD’s offer shorter lock-in periods compared to traditional bank FD’s. This can provide more liquidity if you need access to your funds sooner.

Disclaimer : It's important to diversify your investments across various assets to spread risk and prevent overconcentration in one FD. Carefully review the terms of the FD, comprehending aspects like rates, tenure, penalties, and withdrawal options. Account for liquidity needs by opting for FD’s with reasonable premature withdrawal provisions. While investing in corporate fixed deposits involves inherent risks; thus, exercising caution and informed decision-making is vital. Consult financial experts and conducting thorough due diligence are prudent approaches to navigating these investments effectively.