Let's work together to unlock your financial potential and achieve your dreams

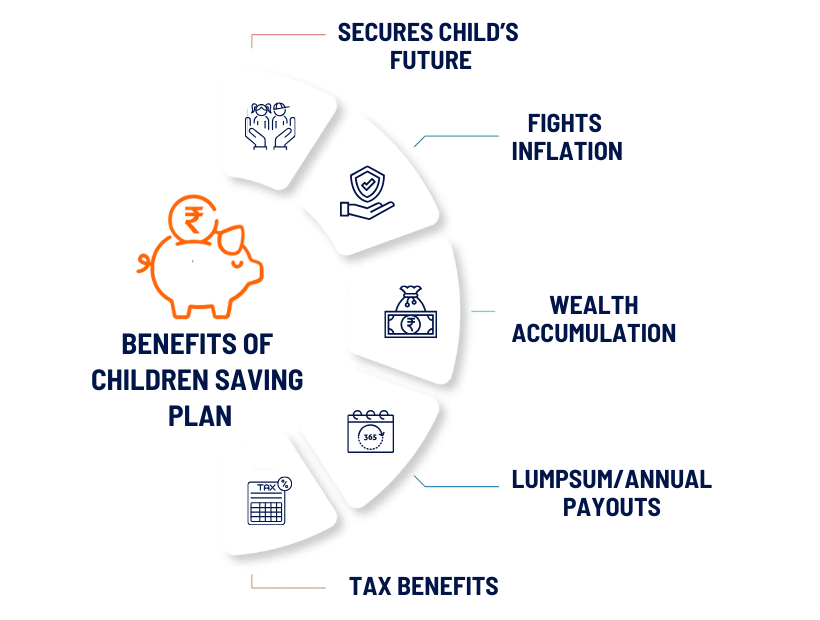

“Children Saving Plan" refers to the strategic process of preparing and securing a child's financial, educational, and overall future needs. It involves setting goals, and implementing strategies to ensure that children have the necessary resources and opportunities for their development, education, well-being, and eventual financial independence.

Savings Accounts: It is a specialized bank account designed for minors, typically managed by a parent or guardian. These accounts often come with specific features like competitive interest rates, zero or low minimum balance requirements

Child Education Savings Plans: These are insurance policies that provide both protection and savings for a child's education. In case of the parent's demise, the child receives a lump sum or periodic payments to fund their education.

Mutual Funds: Investing in mutual funds can be an option for long-term wealth creation for your child. There are mutual funds specifically designed for children, often with an equity-oriented approach for higher potential returns.

Unit Linked Insurance Plans (ULIPs): ULIPs combine insurance and investment features. They allow parents to invest in various funds, including equity and debt, and also provide life insurance coverage. ULIPs offer flexibility in choosing the investment options.

Sukanya Samriddhi Yojana (SSY): This is a government-backed savings scheme aimed at promoting the welfare of the girl child. It offers tax benefits and a higher interest rate than most other savings schemes. The account can be opened for a girl child below the age of 10, and the funds can be withdrawn once the child turns 18 or for her education/marriage.

Public Provident Fund (PPF): While not exclusively for children, parents often open PPF accounts in the name of their children to build a long-term savings corpus. PPF offers tax benefits and has a lock-in period of 15 years, which can be extended.

Fixed Deposits (FDs) and Recurring Deposits (RDs): Many banks offer special FD and RD schemes for children, allowing parents to save a fixed amount of money regularly. These are relatively low-risk investments offering lower returns compared to some other options.

Disclaimer : While choosing investments for children, consider factors such as the investment horizon, risk tolerance, and financial goals. Diversification, which involves spreading investments across different asset classes, can help manage risk and optimize returns. It's advisable to seek guidance from financial advisors to create a comprehensive and effective plan that aligns with your family's aspirations and circumstances.