Let's work together to unlock your financial potential and achieve your dreams

Bonds in India are financial instruments representing debt obligations. They are issued by entities like the government or corporations to raise funds. Bondholders lend money to the issuer in exchange for periodic interest payments (coupon) and the return of the bond's face value at maturity. Bonds typically have fixed maturity dates and offer a predictable source of income for investors. They are traded on stock exchanges and serve as an important investment option.

Government Bonds : These are issued by the Indian government to finance its operations and projects. They are considered low-risk and include instruments like Treasury Bills and Government Securities.

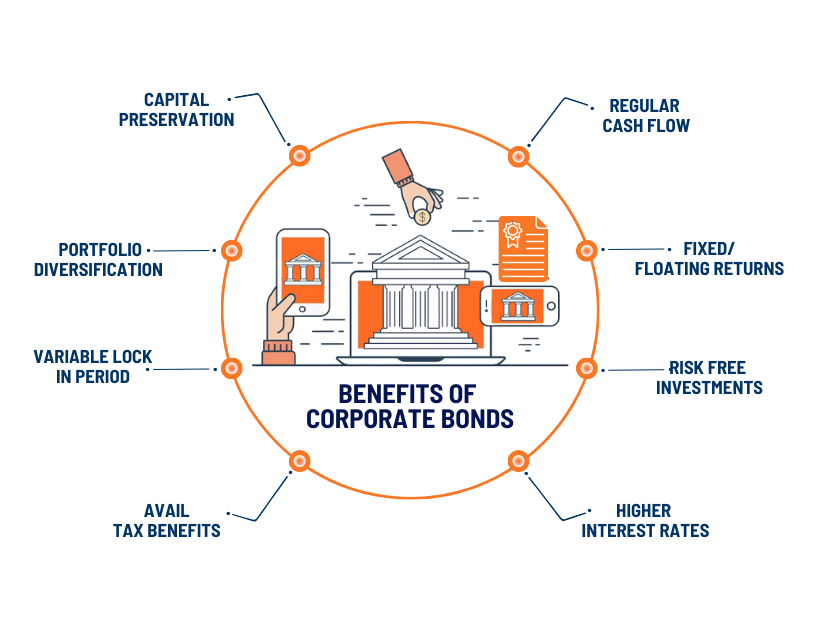

Corporate Bonds : These are issued by corporations to raise capital for various purposes. They offer higher returns than government bonds but come with varying levels of risk depending on the issuer's creditworthiness.

Government Securities (G-Secs) : These are long-term debt securities issued by the Government of India to finance its fiscal deficit. They come in various tenures and carry fixed or floating interest rates.

State Development Loans (SDLs) : Issued by state governments in India, SDLs are debt instruments used to raise funds for state-level development projects. They have varying interest rates and maturities.

Sovereign Gold Bonds : These bonds are denominated in grams of gold and allow investors to invest in gold without owning physical gold. They offer interest in addition to potential gains from gold price appreciation.

RBI Floating Rate Bonds : Also known as Savings Bonds, are government-issued securities in India that offer variable interest rates tied to a benchmark rate. These bonds provide investors with regular interest income that adjusts with changes in the benchmark rate, making them a hedge against interest rate fluctuations. They have fixed tenures and are non-transferable.

Tax-Free Bonds : These bonds offer tax benefits to investors, as the interest income is exempt from income tax. They are typically issued for financing infrastructure projects.

Capital Gain Bonds : These bonds, also known as 54EC bonds, offer tax exemption on capital gains when the sale proceeds from certain assets like real estate are invested in them.

Disclaimer : It's important to note that while bonds offer numerous advantages, they also come with their own set of risks, including interest rate risk, credit risk, and inflation risk. Investors should carefully assess their investment objectives, risk tolerance, and financial situation before investing in bonds. Consulting with a financial advisor can help individuals make informed decisions aligned with their overall financial strategy.