Learn More About ULIP

A Unit Linked Insurance Plan (ULIP) is a financial product that combines insurance and investment elements within a single policy. Policyholders pay regular premiums, a portion of which goes towards providing life insurance coverage, while the remaining amount is invested in various funds like equity, debt, or balanced funds, based on the policyholder's risk appetite and financial goals.

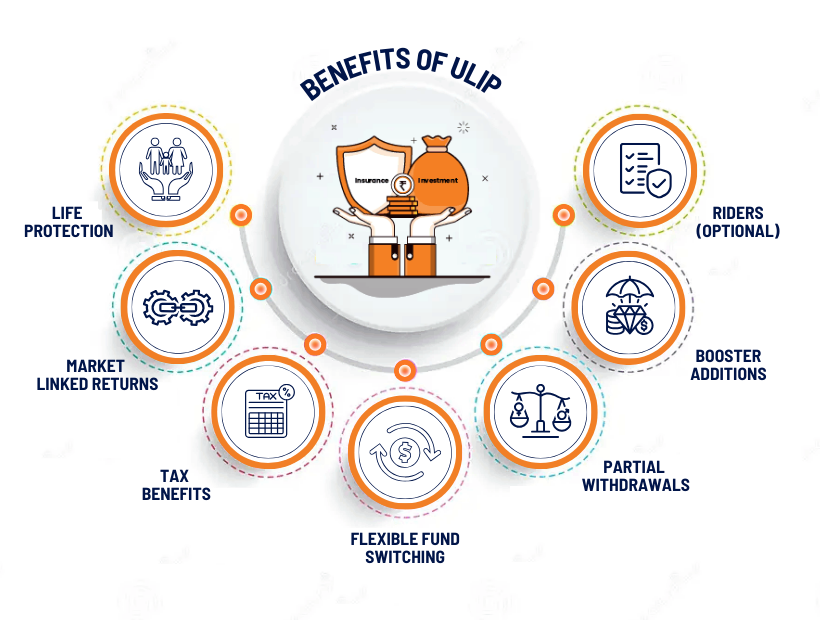

Investment Component : ULIP’s allow policyholders to invest in various funds, such as equity, debt, and balanced funds, based on their risk appetite and financial goals. The policyholder's premium is divided into units, and the value of these units is linked to the performance of the chosen funds.

Insurance Component : ULIP’s also provide life insurance coverage. A portion of the premium goes towards providing life insurance protection to the policyholder. In case of the policyholder's demise during the policy term, the beneficiary receives the sum assured or the fund value, whichever is higher.

Flexibility : Policyholders have the flexibility to switch between different funds based on market conditions, risk tolerance, and investment objectives. They can also allocate their premiums to different funds as per their preferences.

Lock-in Period : ULIP’s have a lock-in period, during which the policyholder cannot surrender or withdraw the entire investment. It encourages long-term investment.

Charges : ULIP’s come with various charges, including premium allocation charges, policy administration charges, fund management charges, mortality charges, and surrender charges. These charges can impact the overall returns, so it's important to understand them before investing.

Tax Benefits : ULIP’s offer tax benefits under Section 80C of the Income Tax Act, allowing policyholders to claim deductions on the premium paid. Additionally, the maturity proceeds are tax-free under Section 10(10D) if particular conditions are met.

Rider Options : Policyholders can enhance their coverage by adding riders, such as critical illness cover, accidental death benefit, disability cover, etc., for an additional premium. This customization allows individuals to tailor the policy to their specific needs.

Market-Linked Returns : The returns from ULIP’s are linked to the performance of the underlying funds. This means that the policyholder's investment returns depend on the market performance of the chosen funds (Equity, Debt, Balanced, etc.)

Transparency :Insurance companies provide with regular statements detailing the fund's performance, the number of units held, and the value of the investment.

Partial Withdrawals : After the lock-in period, policyholders can make partial withdrawals from their ULIP investments without surrendering the entire policy.

Disclaimer : The investment in Unit Linked Insurance Plans (ULIP’s) involves market-linked risks as the value of the underlying funds can fluctuate based on market conditions. Past performance is not indicative of future results, and there is no assurance of returns or capital preservation. ULIP’s also encompass various charges, including premium allocation, policy administration, and fund management charges, which can impact the investment's overall returns. Investors are strongly advised to conduct thorough due diligence, seek professional advice, and carefully assess their risk tolerance and financial goals before investing in ULIP plans. It is recommended to consult with a financial advisor to evaluate personal financial circumstances, risk tolerance, and long-term investment objectives before investing in ULIP’s.